Step-by-Step Guide to Using Fidelity for Crypto Investments Without a Dedicated Wallet

In recent years, cryptocurrency has rapidly gone from a fringe interest to a major component of diversified investment portfolios. As individual investors seek reputable, convenient platforms to gain exposure to digital assets, Fidelity Investments—a household name in traditional finance—has emerged as a stable bridge between conventional investing and emerging crypto markets. This guide will walk you through how to invest in cryptocurrency using Fidelity, without the need for a dedicated crypto wallet. For those who prioritize ease, security, and regulatory compliance, Fidelity offers a controlled, custodial way to gain crypto exposure.

Why Use Fidelity for Digital Asset Investing?

Fidelity offers a compelling solution for investors who wish to enter the cryptocurrency space but are hesitant to manage private keys, third-party wallets, or deal with the complexities of crypto exchanges.

Key advantages include:

- Institutional-Grade Security: Funds are protected with the same rigorous standards used for traditional assets.

- Regulatory Compliance: Fidelity operates under U.S. regulatory frameworks, offering added peace of mind.

- Custodial Services: Digital assets are held securely by Fidelity Digital Assets, eliminating the need for personal wallets.

- Seamless Integration: Crypto holdings appear within the same dashboard as other investments like stocks and mutual funds.

What You’ll Need Before Getting Started

To begin investing in crypto with Fidelity, make sure you meet the following prerequisites:

- A Fidelity Brokerage Account: If you don’t already have one, this can be opened online in a matter of minutes.

- Eligibility: You must be a U.S. resident and over 18 years old.

- Verification Documents: ID verification may be required, particularly for adding new investment services such as crypto access.

Note that crypto trading with Fidelity is currently limited to certain states and may include restrictions depending on regulatory guidelines. Always check your eligibility status when starting out.

Step-by-Step Guide to Investing in Crypto Through Fidelity

1. Open and Fund Your Fidelity Brokerage Account

Visit Fidelity’s official website at www.fidelity.com and follow the process to create a brokerage account. Once open, you’ll need to deposit funds using a linked bank account.

Tip: While there are no minimums for opening the account, ensure that you have sufficient funds for any initial crypto purchase and transaction fees (if applicable).

2. Navigate to the Crypto Investment Section

Fidelity offers crypto access primarily through its dedicated product: Fidelity Crypto. Once your brokerage account is set up and funded:

- Log in to your Fidelity dashboard.

- Search for “Fidelity Crypto” in the search bar or visit the “Products” section.

- Select the crypto trading option and begin the onboarding process.

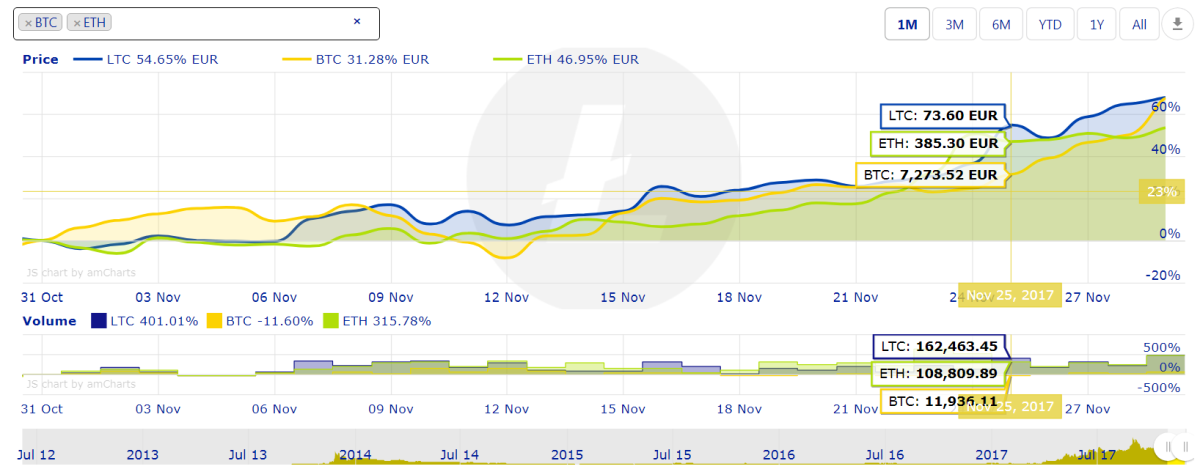

Fidelity currently supports trading for a limited number of cryptocurrencies, primarily Bitcoin (BTC) and Ethereum (ETH). More assets may become available over time.

3. Agree to Terms and Set Up Crypto Access

As this involves a different asset class, you will be required to agree to Fidelity Crypto’s terms and disclosures. These legally binding conditions detail the nature of custodial crypto ownership, transaction processing, and risk warnings.

You’ll also receive information about the custody provider—Fidelity Digital Assets—which safely stores your crypto on your behalf, removing the need for a dedicated personal wallet.

4. Start Trading Digital Assets

Once you’ve completed onboarding to Fidelity Crypto, you can immediately start trading supported cryptocurrencies:

- Select the crypto (e.g., Bitcoin or Ethereum) you wish to purchase.

- Enter the amount in U.S. dollars you want to invest.

- Review transaction details, including any spreads applicable (Fidelity does not charge a separate trading fee, but includes a spread in the pricing).

- Confirm the order.

After the trade executes, the digital assets will be reflected in your Fidelity portfolio. These assets remain in Fidelity’s custody, meaning they cannot be sent to an external wallet.

5. Monitor and Manage Your Holdings

Just like your mutual funds and stock investments, your cryptocurrency assets will appear in your Fidelity dashboard. Here, you can track price movements, view transaction history, and manage your positions.

Important: Since Fidelity handles custody, you will not have access to the digital asset’s private keys. This keeps things simpler and reduces the risk associated with loss or mismanagement, but it does limit interoperability with other crypto platforms.

Fidelity Crypto vs. Traditional Wallet Ownership

For new investors, one common question is how Fidelity compares to managing your own crypto using dedicated wallets like MetaMask, Ledger, or Coinbase Wallet. Here are a few key differences:

| Feature | Fidelity Crypto | Dedicated Wallet |

|---|---|---|

| Custody | Fidelity holds your crypto securely | You hold the private keys yourself |

| Security Risk | Lower (Fidelity insures and secures funds) | Higher (User error or theft risk) |

| Ease of Use | Very simple and beginner-friendly | Requires knowledge of wallets and blockchain processes |

| Interoperability | Limited (no external transfers) | High (can interact with DeFi, NFTs, etc.) |

Security and Reliability: What You Should Know

One of the primary reasons investors opt for Fidelity over other platforms is the assurance of institutional-grade security. Fidelity uses cold storage mechanisms, multi-layered authentication, and internal risk mitigation protocols to protect funds.

Furthermore, Fidelity is a long-established institution with a reputation for reliability, so the risk of service interruption or fraud is significantly minimized compared to newer cryptocurrency exchanges or wallet providers.

Who Is This Approach Best For?

Fidelity’s hands-off crypto investment system is ideal for:

- Long-term investors who want exposure to crypto without the burden of managing wallets.

- Beginners in crypto who are more comfortable with a familiar brokerage interface.

- Financially conservative users looking for a regulated product.

However, it may not be the best fit for those seeking active trading capabilities, access to a broader range of altcoins, or functions like staking, swapping, or NFT participation.

Final Thoughts

For many mainstream investors, Fidelity offers a balanced gateway into the world of crypto assets—combining the innovation of digital currencies with the reliability of a traditional financial institution. While it does limit certain freedoms associated with decentralized finance, the convenience, security, and regulation Fidelity provides make it a strong choice for anyone prioritizing simplicity and peace of mind.

Whether you’re considering adding exposure to Bitcoin or Ethereum to diversify your portfolio, Fidelity’s custodial approach enables you to do so without having to manage private keys or worry about securing a crypto wallet. With a few simple steps, you can integrate digital assets into your investment strategy, securely and efficiently.